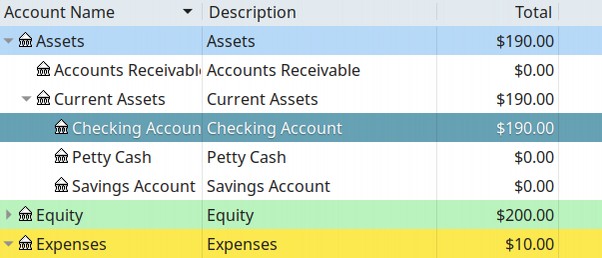

In this lesson, we will show you how to keep track of every dollar that comes into your business (aka your business income) and every dollar that goes out of your business (aka your business expenses). Money coming in and money going out are called Financial Transactions. The whole point of a Financial Management Program is to keep track of and organize all of your business financial transactions.

There are several reasons you need to keep track of your business income and expenses. First, you not only need to tell whether you are making a profit or loss on the entire business, but also where you are making the most money and where you are losing the most money. You will stay in business longer if you keep track of the various sources of your income and the various categories of your expenses.

Second, if you want to persuade other people to invest in your business so you can grow your business more rapidly, you will need to be able to prove to them that you are making a real profit – not merely that you have a good idea. Third, while you will not have to file state and federal tax reports for a simple lemonade stand, you will have to file precise reports to the state and federal government if you make more than a few thousand dollars a year. And if you have a real business, at some point you will be making several thousand dollars per year in sales. The government will allow you to deduct your business expenses from your business sales to determine your net business income. But to get these deductions, you have to define all of your expenses by very specific categories.

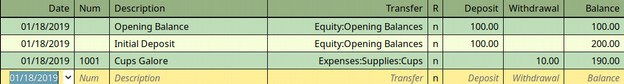

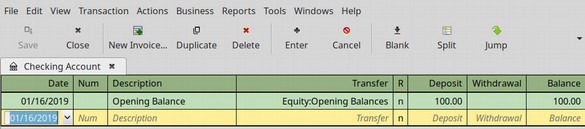

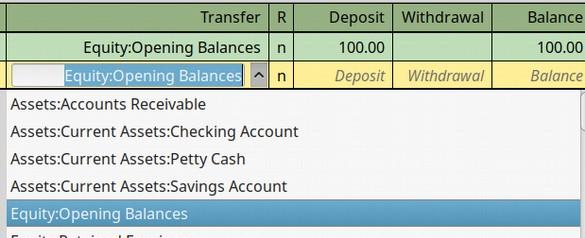

Thirty years ago, in the days before personal computers, one of the first things any new business owner would do was purchase a Business Ledger Book. This ledger book was essentially a series of big pages with each page containing a giant table with 20 to 30 rows and 10 to 20 columns. Each row was a new transaction – an income deposit or an expense withdrawal. Each column was a different kind of income or a different category of expense. At the bottom of each page, the business owner would add up all of the rows and columns to make sure each page balanced.

These ledger page totals would then be added up to make sure each day, each week and each month balanced and that everything matched the monthly statement from your bank.